Medicare Supplements

When Turning 65, it is very important that you choose to work with an independent agent that represents all of the various insurance companies.

Secondly, it is important, too, that the agent knows how to help you in year two, year three, etc. rather than just constantly chasing those new clients that are turning 65.

How to write a fully underwritten

You see, when an agent’s practice is solely dependent upon new seniors turning 65, that agent literally does not know how to write a fully underwritten (non-65 year old) case. That is critical. I work for MY senior clients, NOT for the insurance companies. This way, I can shop the market independently for the best possible value for your insurance premium dollar.

Medicare Supplement plans

As you can see in the Medicare & You Guidebook, all of the Medicare Supplement plans are exactly identical, regardless of the company. They all pay the bills exactly the same way for the same amount, and are all accepted at every Medicare provider the same way.

The only difference, sometimes to the tune of $1,200 or more per year, is the price that your agent is able to find in the marketplace for you. And this should be shopped every year. Guess what happens when you sign up with a “Turning 65” only Medicare agent? They’re off next week looking for that next “turning 65” senior and they’re not taking care of you. This experience is from working with 100’s of Seniors for nearly 20 years.

Dental & Vision

Senior Insurance Sales offers free, comparative quotes on dental and vision insurance from multiple insurance carriers so you can get the best possible rate.

- You Can Choose ANY Provider - NO NETWORKS!

- No Waiting Period for Preventive & Basic Services

- Guaranteed Issue - No Health Questions

- Guaranteed Renewable for Life

- $1,500 Maximum benefit for Dental, Vision, or Hearing

- Low ($100) Annual Deductible

- Benefits increase each year up to 80% Coverage

- Month to Month Policy with No Contract

Want to see how much we can save you? Call us now!

Medicare Advantage

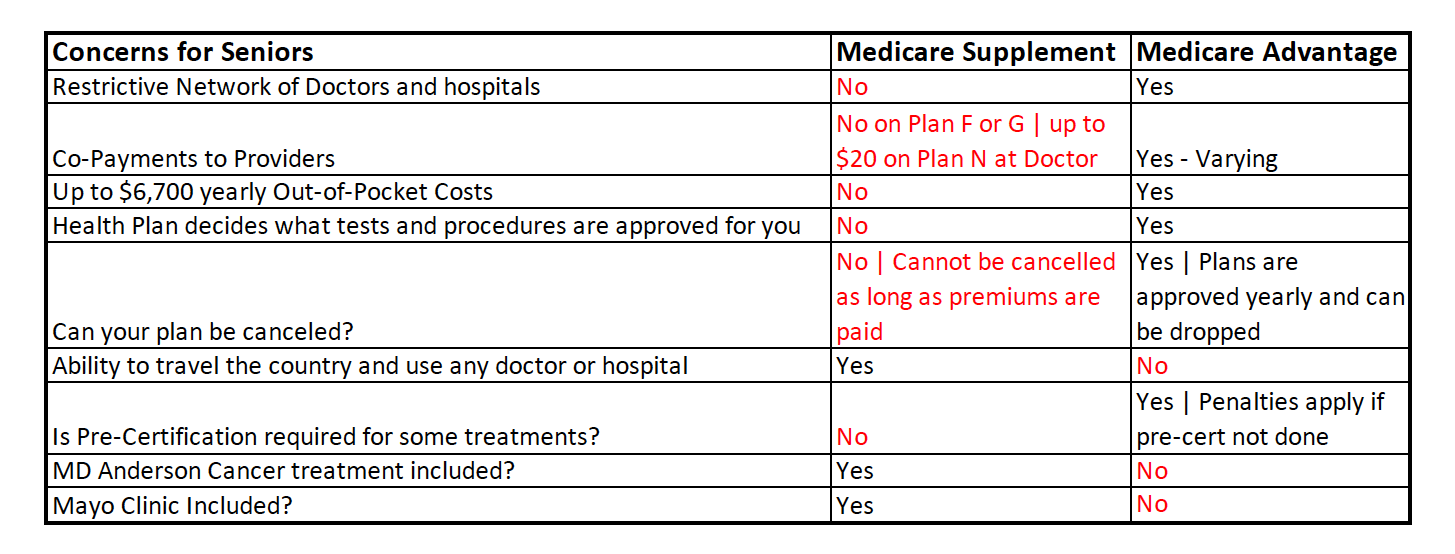

Consider this: The clients we help are usually on a fixed income when they retire. This means that our senior clients do not like surprises with their health plan or their budget when a significant health event happens.

As you can see, with a Medicare Supplement policy, you have consistent monthly premiums. With a Medicare Advantage Plan, you could have a big surprise when you need hospital services. Take a look at the chart below and see how Medicare Advantage and Medicare Supplement matchup.